US Senate & House Take Up SEC Disgorgement After Kokesh: 2019 Year-In-Review Part 2

Congress took up SEC disgorgement during 2019

In today’s post, I discuss certain developments in 2019 that concern the continued viability of SEC disgorgement as a remedy against securities law violators.

These 2019 developments are of great relevance to both SEC defendants and SEC whistleblowers alike, and are worth following as we head into 2020.

For decades it has been accepted that the SEC can seek disgorgement in court actions.

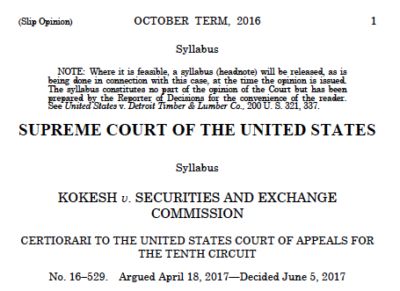

However, in 2017, the U.S. Supreme Court ruled that SEC disgorgement is a “penalty” and therefore subject to a five-year statute of limitations. That case was Kokesh v. Securities and Exchange Commission, 137 S. Ct. 1635 (2017).

The SEC estimates that as a result of the Supreme Court’s Kokesh decision and the five-year statute of limitations, it has already been prevented from recovering approximately $1.1 billion from securities law violators that otherwise might have been returned to harmed investors.

Following on the heels of the Kokesh case, in 2019 the Supreme Court agreed to hear a different case to decide whether the SEC even has the authority to seek and obtain disgorgement at all. (Liu v. SEC, No. 18-1501 (U.S. 2019).)

During 2019, in response to both the Supreme Court’s Kokesh ruling and its agreeing to hear the Liu case, both houses of the U.S. Congress introduced bills to clarify and formalize the SEC’s disgorgement powers.

First Some Background: What Is The Difference Between SEC Disgorgement And Civil Restitution?

In an SEC enforcement action, the SEC sues a fraudster on behalf of the U.S. government for breaking the law, not because the fraudster swindled the SEC or stole money from the SEC. Rarely if ever is the SEC the “victim” in a typical SEC enforcement action.

“Disgorgement” has traditionally referred to making wrongdoers give up something they got that they are not entitled to, sometimes referred to as “ill-gotten gains” or “unjust enrichment”. In an SEC disgorgement case, if the SEC wins, the court may order the fraudsters to “disgorge” or turn over their ill-gotten gains to the SEC.

By contrast, in some private lawsuits, a person (the plaintiff) might sue a wrongdoer for defrauding them or stealing from them. In these types of cases, the person (the plaintiff) is the victim.

In a private lawsuit, if the plaintiff wins, the court may order the fraudster to make “restitution” or return the victim’s money or property back to the victim.

One of the big differences between SEC disgorgement and restitution is that in restitution the money goes back to the victim, not to the SEC.

When the SEC wins “disgorgement”, it may put the money into a fund from which it tries to repay the investors who lost money in the fraudster’s scam. But what the SEC got from the court in the first place was disgorgement. Setting up an investors fund and returning investors’ money to them from out of that fund does not magically transform the SEC disgorgement that it got from the court into restitution.

While this “disgorgement” and “restitution” language may sound like a bunch of technical legalese, it can have significant ramifications.

Some of those ramifications became apparent as a result of the Supreme Court’s 2017 Kokesh decision.

According To The U.S. Supreme Court, SEC Disgorgement Is A Penalty

The US Supreme Court's Kokesh Opinion

28 U.S.C. § 2462 says that in any “action, suit or proceeding for the enforcement of any civil fine, penalty, or forfeiture”, the statue of limitations is five (5) years.

According to the Supreme Court, when the SEC seeks disgorgement in an enforcement action, the SEC disgorgement operates as a “penalty”. Therefore, the Court said, because SEC disgorgement is a penalty, it falls under 28 U.S.C. § 2462. (Kokesh at 1.)

As a result of that ruling, the SEC has since been required to bring its disgorgement actions within five years from the date on which its cause of action accrued.

Implications For SEC Defendants And Securities Attorneys

As a result of the Kokesh decision, the SEC may have to investigate and file its cases faster than it did before.

The Kokesh ruling gives securities attorneys another tool in defending their clients in SEC investigations and cases. It means that if the SEC takes too long to investigate and file its case in court, a securities lawyer might be able to ask the court to throw out the SEC disgorgement claim against his or her client.

Furthermore, some securities lawyers have since argued that SEC disgorgement is a common law equitable remedy not explicitly authorized by any statute, and therefore the SEC should not be allowed to pursue disgorgement in court. For example, compare Jalbert v. SEC, Civ. Action No. 17-12103-FDS (D. Mass. Aug 22, 2018) with Saad v. SEC, 873 F.3d 297 (D.C. Cir. 2017).

There is even a case before the U.S. Supreme Court right now asking the Court to rule that the SEC should not be allowed to seek disgorgement at all, because SEC disgorgement is a “penalty”. (See Brief for Petitioners in Liu v. SEC, No. 18-1501 (U.S.), Brief filed on Dec. 16, 2019.)

While these might be interpreted as potentially positive developments for defense lawyers and their clients, it could also cause them some practical difficulties.

For example, the five-year statute of limitations could lead the SEC to drive its investigations harder and faster, giving defendants less time to gather their own evidence and prepare their defenses, and less ability to delay the moment of truth if/when the SEC files a case against them.

Faster and harder investigations might also lead to SEC defendants having less ability to spread their costs and legal fees out over time. If the SEC conducts its investigations and brings its cases faster, defendants without insurance coverage or large up front war chests may find it more of a struggle to keep up with rapidly mounting legal costs during the SEC’s accelerated investigations.

Implications For SEC Whistleblowers And Whistleblower Attorneys

The five-year statute of limitations also has important implications for SEC whistleblowers and SEC whistleblower attorneys.

A former Director of the SEC’s Enforcement Division gave a speech about the SEC whistleblower program. In that speech, he stated that whistleblowers should report their information to the SEC as soon as they learn of misconduct. In the context of the former Director’s speech, he was referring to the “unreasonable delay” factor that can cause the Commission to reduce, sometimes drastically, the ultimate amount of an SEC whistleblower award. [Click here to read my post about the former Director’s speech.]

The former Director’s warning is even more relevant post-Kokesh. If an SEC whistleblower waits too long to report a fraud to the SEC, the SEC might not have enough time to investigate and bring all of the possible charges against the fraudsters before the five years runs out.

The five-year statute of limitations on SEC disgorgement, and its classification as a “penalty”, could have other very significant implications for whistleblowers and SEC whistleblower lawyers.

For example, the SEC might not be able to recover in disgorgement all of the money that investors lost, which means that the SEC might not be able to return all of the defrauded investors’ money to them.

This was confirmed on December 10, 2019, when the SEC’s Chairman testified before the U.S. Senate Committee on Banking, Housing, and Urban Affairs about the impact of the Supreme Court’s Kokesh ruling:

The Supreme Court’s decision in Kokesh v. SEC, however, has impacted our ability to return funds fraudulently taken from Main Street investors…. Said simply, the Kokesh decision has had the anomalous effect of allowing the most “successful” perpetrators of fraud -- those whose frauds are well-concealed and stretch beyond the five-year limitations period -- to keep their ill-gotten gains. Since Kokesh was decided, an estimated $1.1 billion in ill-gotten gains has been unavailable for possible distribution to harmed investors, much of which is tied to losses by investors. More recently, the SEC’s ability to seek disgorgement in any district court action has been questioned. (Underline added.)

In addition, SEC whistleblower rewards are based upon the amount of money that the SEC collects from the wrongdoers. A large part of that amount consists of the SEC disgorgement.

If a whistleblower delays too long in reporting to the SEC, the SEC might not have enough time to investigate and bring as strong of a case as it otherwise could have if the whistleblower had reported promptly and given the SEC more time. If that happens, the amount of the disgorgement that the SEC is able to collect from the wrongdoers could be significantly diminished, which could lead to a lower award for the dilatory SEC whistleblower.

The US House Of Representatives’ Bill On SEC Disgorgement

The House bill on SEC disgorgement

During 2019, both the U.S. Senate and the U.S. House of Representatives introduced bills addressing the Supreme Court’s Kokesh ruling.

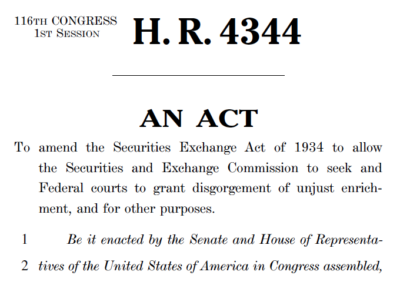

On September 17, 2019, the “Investor Protection and Capital Markets Fairness Act” was introduced in the U.S. House of Representatives. (H.R. 4344.) The bill was co-sponsored by Representative McAdams and Representative Huizenga.

The bipartisan House bill would authorize the SEC to obtain disgorgement in any Federal Court action.

The bill also states that SEC disgorgement is not to be construed as a penalty, civil fine, or forfeiture.

Moreover, the House bill would extend the statute of limitations in SEC disgorgement actions to fourteen (14) years after the alleged violation.

During the debate on the House floor, several U.S. Representatives specifically discussed the Supreme Court’s Kokesh decision. For example, Representative Green stated:

In 2017, the Supreme Court, in Kokesh v. SEC, held that the authority of the Securities and Exchange Commission, SEC, to recover for investors the wrongful gains of securities law violators, known as disgorgement, is effectively a penalty. As a result, the SEC’s authority to obtain disgorgement is time limited by the Federal statue of limitations for penalties so that the SEC must bring its case within 5 years of the violation.

This ruling was a boon to white-collar criminals like Bernie Madoff and Allen Stanford, who are now able to defraud investors for a decade and keep their profits.

Even worse, the SEC is currently in litigation before the Supreme Court over whether it even has the authority to obtain disgorgement for investors.

Representative McAdams added, “this legislation seeks to fix the Kokesh decision and would address the recent case the Supreme Court agreed to hear about whether the SEC has disgorgement authority at all”.

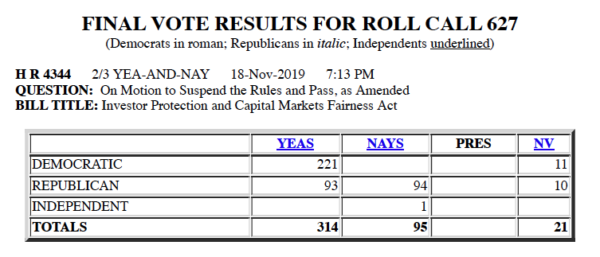

On November 18, 2019, the House bill passed by a vote of 314 - 95, with 21 not voting. The next day it was received in the U.S. Senate and referred to the Senate’s Committee on Banking, Housing, and Urban Affairs.

The House vote on SEC disgorgement

The US Senate’s Bill On SEC Disgorgement

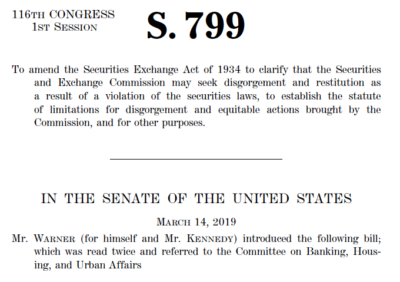

The Senate bill is called the “Securities Fraud Enforcement and Investor Compensation Act of 2019”. Senator Warner and Senator Kennedy co-sponsored the bipartisan bill.

The bill was introduced on March 14, 2019 to amend the securities laws by clarifying that the SEC “may seek disgorgement and restitution as a result of a violation of the securities laws, to establish the statue of limitations … and for other purposes”.

The Senate bill on SEC disgorgement

The Senate’s bill would give the SEC the explicit authority to seek disgorgement “in any action or proceeding brought by the Commission under any provision of the securities laws”. The Commission would also be authorized to seek restitution, in which case the amount of the disgorgement ordered would be offset by the amount of the restitution also ordered.

However, under the Senate bill, SEC disgorgement would continue to be subject to a five-year statute of limitations. Restitution, on the other hand, would have a ten-year statute of limitations.

It should be kept in mind, though, that the Senate bill was introduced approximately eight months before the Senate received the House’s bill, and almost nine months before the SEC Chairman’s testimony before the Senate Committee on Banking, Housing, and Urban Affairs, so it is possible that the Senate bill could be amended or reconciled with the House’s bill.

<- For Part 1 of my 2019 Year-In-Review, click here.

For Part 3 of my 2019 Year-In-Review, click here. ->

* * *

About the Pickholz Law Offices LLC

The Pickholz Law Offices LLC is a law firm that focuses on representing clients involved with investigations conducted by the U.S. Securities and Exchange Commission, FINRA, and other securities regulators.

The Pickholz Law Offices has represented employees, officers, and others in SEC whistleblower cases involving financial institutions and public companies listed in the Fortune Top 10, Top 20, Top 50, Top 100, Top 500, and the Forbes Global 2000. We were the first law firm ever to win an SEC whistleblower award for a client on appeal to the full Commission in Washington. Inside Counsel magazine named this achievement one of the five key events of the SEC whistleblower program. Examples of the Firm’s SEC whistleblower cases are available here.

In addition to representing SEC whistleblowers, since 1995 the Firm’s founder, Jason R. Pickholz, has also represented many clients in securities enforcement investigations conducted by the SEC, FINRA, the U.S. Department of Justice and US Attorney’s Offices, State authorities, and more. Examples of some of the many securities enforcement cases that Mr. Pickholz has been involved with are available here.

You can see what actual clients have had to say about The Pickholz Law Offices by going to the Client Reviews page on our website or by clicking here.

How to Contact the Pickholz Law Offices LLC

If you would like to speak with a securities lawyer or SEC whistleblower attorney, please feel free to call Jason R. Pickholz at 347-746-1222.

The Pickholz Law Offices remains open and will be fully operational through teleworking while we all grapple with this terrible pandemic. We hope that all of our clients, colleagues, friends, and their families remain safe and healthy. Our thoughts and prayers go out to everyone who has been affected by COVID-19.