Insider Trading: Historic US House Bill Would Clarify What It Is And When It Is Illegal

2019 Year-In-Review Part 3

For many years, it has been axiomatic that insider trading is illegal. However, what exactly insider trading is and how to define it has caused some difficulty and conflict among the courts.

In large part that is because -- believe it or not -- there is no federal statue actually defining what insider trading is.

Therefore, what the U.S. Securities and Exchange Commission commonly does is to bring cases for the “employment of manipulative and deceptive devices”, in violation of Section 10b of the Securities Exchange Act of 1934, 15 U.S.C. § 78j(b); Section 17 of the Securities Act of 1933, 15 U.S.C. § 77q; and/or SEC Rule 10b-5, 17 CFR § 240.10b-5.

The insider trading is then put forth as the “manipulative and deceptive device” that was used to violate those laws.

Without a specific insider trading statue, it has been left to the federal courts on a case-by-case basis to try to define what insider trading is, and what elements have to be proven to hold someone liable for it.

As can be imagined, different judges may have different opinions. Over time this led to differing views as to what exactly constitutes insider trading.

That confusion came to a head in December 2014, when one U.S. Court of Appeals issued a ruling in an insider trading case that to many appeared to clash with more than 30 years of legal precedent.

During 2019, the U.S. House of Representatives introduced a potentially historic insider trading bill to try to clear up the confusion and establish a single set of statutory elements to be applied in insider trading cases.

Why Is Congress Dealing With Insider Trading Now?

Chiarella insider trading case (1980)

For decades, the seminal insider trading cases have been Chiarella v. U.S., 445 U.S. 222 (1980), and Dirks v. SEC, 463 U.S. 646 (1983).

Then, in 2014, the U.S. Court of Appeals for the Second Circuit set securities attorneys and the legal world abuzz by reversing the insider trading convictions of two portfolio managers in a case called U.S. v. Newman, 773 F.3d 438 (2d Cir. 2014).

It was not the reversal of the convictions that created so much controversy; it was the reasons the Second Circuit gave for doing so.

Dirks insider trading case (1983)

The government had accused the two portfolio managers of being “tippees”. Broadly speaking, a “tippee” is someone who receives confidential, non-public inside information from someone else and then trades (buys or sells) securities based on that non-public inside information.

The Second Circuit held that in order to convict a tippee of insider trading, the government must prove that an insider (the “tipper”) disclosed confidential inside information. In addition, the government has to prove (1) that the tipper received a personal benefit from providing the inside information to the tippee, and (2) that the tippee knew that he or she was trading on confidential information that the tipper provided to them in violation the tipper’s fiduciary duties. There is not too much that is controversial about those statements.

Newman insider trading case (2014)

But the Second Circuit went further by holding that for a tippee to be liable for insider trading, he or she must also know that the tipper received a personal benefit from providing that inside information to him or her.

Furthermore, the Second Circuit held that in order to draw an inference that a tipper received a benefit from tipping off a friend or relative, the government has to prove “a meaningfully close personal relationship that generates an exchange that is objective, consequential, and represents at least a potential gain of a pecuniary or similarly valuable nature.” (Newman, 773 F. 3d at 452.)

In 2016, the U.S. Supreme Court ruled on a case called Salman v. U.S., 137 S. Ct. 420 (2016). In that case, the Supreme Court said that the Second Circuit’s Newman ruling did not properly follow Dirks v. SEC.

According to the Supreme Court, under Dirks, a jury is allowed to infer that the tipper personally benefitted from making a gift of the confidential inside information to a relative (tippee) who then traded on that information. (Salman, 137 S. Ct. at 428.)

Salman insider trading case (2016)

However, the Supreme Court did not review the Second Circuit’s other ruling in Newman that a tippee has to know that the tipper received a personal benefit from providing that inside information to him or her. (Salman, 137 S. Ct. at 425 n.1.)

Because of the Supreme Court’s narrow decision in Salman, there has continued to be disagreement and confusion over whether the Second Circuit’s other ruling in Newman -- that a tippee has to actually know that the tipper got a personal benefit -- is correct and should be followed.

Enter Congress

On May 7, 2019, the “Insider Trading Prohibition Act” was introduced in the U.S. House of Representatives (H.R. 2534).

On September 27, 2019, The House Committee on Financial Services released its Report on the bill.

The Report explains the purpose of the insider trading bill:

H.R. 2534, the Insider Trading Act … formally codifies the prohibition against insider trading, creating a clear, consistent standard for both courts and market participants to follow. The bill largely codifies the existing case law on insider trading. However, the bill overturns a controversial judicially-imposed requirement that an individual who receives insider information know about the specific personal benefit received by the individual who discloses the information.

A footnote in the Report specifically identifies the Second Circuit’s Newman opinion as the “controversial judicially-imposed requirement” being referred to in the passage quoted above. (Report at 3 n.1, and at 4.)

The House’s Insider Trading Prohibition Act (May 2019)

The bill would amend the Securities Exchange Act of 1934 by adding a new Section 16A titled “Prohibition On Insider Trading”.

Subsection 16A(a) of the bill would make it:

… unlawful for any person, directly or indirectly, to purchase, sell, or enter into, or cause the purchase or sale or entry into, any security, security-based swap, or security-based swap agreement, while aware of material nonpublic information … from whatever source, that has, or would reasonably be expected to have, a material effect on the market price … if such person knows, or recklessly disregards, that such information has been obtained wrongfully, or that such purchase or sale would constitute a wrongful use of such information.

Subsection 16A(b) describes conduct that would give rise to tipper liability for insider trading.

Subsection 16A(c)(1) states that communicating or trading on material non-public information is only wrong if the information was obtained by, or if its communication would constitute, directly or indirectly, certain types of conduct. The list of those types of conduct is extensive.

Some of the types of conduct listed include various forms of theft, misrepresentation, deceptive taking, bribery, and violations of federal computer data or computer privacy laws. The list also includes breaches of fiduciary duty, breaches of contract, or breaches:

… of any other personal or other relationship of trust and confidence for direct or indirect personal benefit (including pecuniary gain, reputational benefit, or a gift of confidential information to a trading relative or friend).

Subsection 16A(c)(2) makes clear that “it shall not be necessary” that either a tipper or a person trading on the inside information

… knows the specific means by which the information was obtained or communicated, or whether any personal benefit was paid or promised by or to any person in the chain of communication, so long as the person … was aware, consciously avoided being aware, or recklessly disregarded that such information was wrongfully obtained, improperly used, or wrongfully communicated.

The bill contains several provisions and subsections in addition to those described above. To read the bill for yourself, click here.

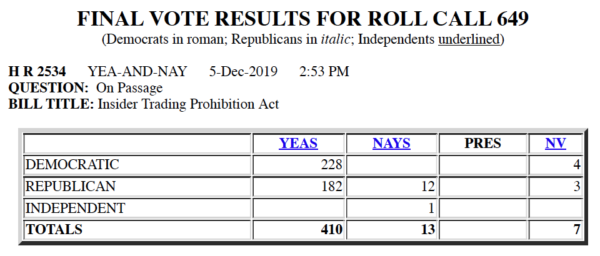

On December 5, 2019, the House bill was passed by a vote of 410 - 13, with 7 not voting.

The House vote on the Insider Trading Prohibition Act (December 2019)

After passing the House, the bill was then received in the Senate and referred out to committee. Should the Senate pass the bill or some variation of it during 2020, it would become the nation's first comprehensive insider trading law ever.

For a more detailed discussion of insider trading and the odds of the Insider Trading Prohibition Act becoming law during 2020, see here.

For Part 1 of my 2019 Year-In-Review, click here. ->

For Part 2 of my 2019 Year-In-Review, click here. ->

* * *

About the Pickholz Law Offices LLC

The Pickholz Law Offices LLC is a law firm that focuses on representing clients involved with investigations conducted by the U.S. Securities and Exchange Commission, FINRA, and other securities regulators.

The Pickholz Law Offices has represented employees, officers, and others in SEC whistleblower cases involving financial institutions and public companies listed in the Fortune Top 10, Top 20, Top 50, Top 100, Top 500, and the Forbes Global 2000. We were the first law firm ever to win an SEC whistleblower award for a client on appeal to the full Commission in Washington. Inside Counsel magazine named this achievement one of the five key events of the SEC whistleblower program. Examples of the Firm’s SEC whistleblower cases are available here.

In addition to representing SEC whistleblowers, since 1995 the Firm’s founder, Jason R. Pickholz, has also represented many clients in securities enforcement investigations conducted by the SEC, FINRA, the U.S. Department of Justice and US Attorney’s Offices, State authorities, and more. Examples of some of the many securities enforcement cases that Mr. Pickholz has been involved with are available here.

You can see what actual clients have had to say about The Pickholz Law Offices by going to the Client Reviews page on our website or by clicking here.

How to Contact the Pickholz Law Offices LLC

If you would like to speak with a securities lawyer or SEC whistleblower attorney, please feel free to call Jason R. Pickholz at 347-746-1222.

The Pickholz Law Offices remains open and will be fully operational through teleworking while we all grapple with this terrible pandemic. We hope that all of our clients, colleagues, friends, and their families remain safe and healthy. Our thoughts and prayers go out to everyone who has been affected by COVID-19.