Does The SEC Give Sufficient Notice To Claim An SEC Whistleblower Award?

-- 2 Whistleblowers Ask The Second Circuit To Decide --

Under the SEC whistleblower program, people who provide information about securities frauds to the U.S. Securities and Exchange Commission can receive monetary whistleblower awards. Those awards can range from 10% - 30% of the amount of fines and penalties that the SEC collects from the transgressors, so long as the SEC collects more than $1 million from the perpetrators of the fraud. In some cases, the SEC has given out whistleblower awards of millions or even tens of millions of dollars. But there are a lot of rules about what a whistleblower must do to be eligible to claim an SEC whistleblower award.

Last week, the U.S. Court of Appeals for the Second Circuit heard oral arguments in a case challenging one of those rules. The rule being challenged has to do with the kind of notice that the SEC must give to let people know that they should file their applications to claim an SEC whistleblower award in a particular case.

The 90-Day Window To Claim An SEC Whistleblower Award

As background, to claim an SEC whistleblower award, the claimant must submit his or her application for an award within 90 days of the date on which the SEC wins its monetary judgment or order against the wrongdoers.

The order or judgment could be in the form of a court order requiring the defendants to pay disgorgement, interest, and/or penalties to the SEC. It could be the result of an in-house SEC administrative proceeding. Or it could be the result of a settlement between the alleged wrongdoers and the SEC.

Unless there are extenuating circumstances, if someone does not submit his or her claim for an SEC whistleblower reward within the 90-day window, he or she will be barred from receiving a reward.

The Commission has sole discretion to determine whether it believes there are sufficient extenuating circumstances to warrant an exception for someone who misses the 90-day deadline.

In the case before the Second Circuit, the two whistleblowers put in their claim for an SEC whistleblower award approximately two years after the 90-day window had expired. The SEC did not grant them an exception to the filing deadline and denied their award claims.

How Does Someone Find Out When Their Time To Claim An SEC Whistleblower Award Has Begun To Run?

The current practice is that when the SEC collects over $1 million in a case, it posts the name of that case on a list on the SEC’s website. That list is called a Notice of Covered Actions or “NoCA” list.

The SEC may not post a case on its NoCA list until a few days or even weeks after it wins a judgment or order of over $1 million. Recognizing this, the SEC has interpreted the 90-day window for award applications to begin running from the date when the case first appears on the NoCA list, not the earlier date when the SEC actually got the order or judgment. In some cases, where the whistleblower learns of the order or judgment in advance of the NoCA listing, this could give his or her SEC whistleblower lawyer some extra time in preparing the application for an award.

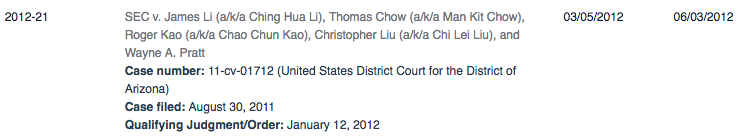

The NoCA list sets forth the case name, the date on which the case was posted, and the date by which award claims are due. This is called “constructive notice” to the public.

The practice of giving “constructive notice” places the onus on SEC whistleblowers to monitor the NoCA list themselves so that they do not miss their filing deadline to claim an SEC whistleblower award.

Some applicants in prior cases who were denied awards argued that the Commission was either required to or should have given them “actual notice” that their time to claim an SEC whistleblower award had begun to run. In those cases, the Commission rejected the notion that it was required to provide “actual notice” by calling, writing, or otherwise contacting every (or any) potential award claimant directly.

The Second Circuit Case

The SEC’s practice of providing constructive notice through its NoCA list is what is being challenged in the case presently before the Second Circuit.

The SEC posted the case on the NoCA list on its website. But the two award claimants said that they never saw it or knew about it, which is why they did not file their award claims until approximately two years later.

NoCA listing for the case on the SEC's website

The Second Circuit heard oral arguments in the case last week. During oral arguments, the two award claimants asked the Second Circuit to rule that the SEC was either required to or should have been required to provide them with actual notice that an award had become available and that their time to file for an award had begun to run.

The Second Circuit has posted an audio transcript of the oral arguments in the case. You can listen to the oral arguments by going to the Second Circuit's website here and searching for Cerny v. U.S. Securities and Exchange Commission (docket #16-934, date argued: August 30, 2017).

Update: On September 7, 2017, the day after this post, the Second Circuit ruled that “the Commission is not required to provide actual notice” to potential SEC whistleblower award claimants. (See Cerny v. SEC, Summary Order at 4, docket #16-934-ag (2d. Cir., Sept. 7, 2017).)

* * *

About the Pickholz Law Offices LLC

The Pickholz Law Offices LLC is a law firm that focuses on representing clients involved with investigations conducted by the U.S. Securities and Exchange Commission, FINRA, and other securities regulators.

The Pickholz Law Offices has represented employees, officers, and others in SEC whistleblower cases involving financial institutions and public companies listed in the Fortune Top 10, Top 20, Top 50, Top 100, Top 500, and the Forbes Global 2000. We were the first law firm ever to win an SEC whistleblower award for a client on appeal to the full Commission in Washington. Inside Counsel magazine named this achievement one of the five key events of the SEC whistleblower program. Examples of the Firm’s SEC whistleblower cases are available here.

In addition to representing SEC whistleblowers, since 1995 the Firm’s founder, Jason R. Pickholz, has also represented many clients in securities enforcement investigations conducted by the SEC, FINRA, the U.S. Department of Justice and US Attorney’s Offices, State authorities, and more. Examples of some of the many securities enforcement cases that Mr. Pickholz has been involved with are available here.

You can see what actual clients have had to say about The Pickholz Law Offices by going to the Client Reviews page on our website or by clicking here.

How to Contact the Pickholz Law Offices LLC

If you would like to speak with a securities lawyer or SEC whistleblower attorney, please feel free to call Jason R. Pickholz at 347-746-1222.

The Pickholz Law Offices remains open and will be fully operational through teleworking while we all grapple with this terrible pandemic. We hope that all of our clients, colleagues, friends, and their families remain safe and healthy. Our thoughts and prayers go out to everyone who has been affected by COVID-19.