SEC Says Co. Violated Whistleblower Protection Rules By Impeding Investors

The U.S. Securities and Exchange Commission recently amended a court Complaint to add charges that a company and its owner violated SEC whistleblower protection rules. (For past cases in which the SEC brought actions against companies for violating whistleblower protection rules, see my earlier post here.)

The recent case is SEC v. Collector’s Coffee, Inc. d/b/a Collectors Café, and Mykalai Kontilai. According to the SEC’s amended Complaint in that case, the defendants violated SEC whistleblower protection rules by:

(1) conditioning the return of investors’ money on their agreement to sign stock purchase agreements that contained a provision prohibiting them from contacting law enforcement (Amd. Cplt. at 28);

(2) settling an investors’ lawsuit by inserting a clause into the settlement agreement prohibiting the investors from contacting the SEC or any other regulatory or governmental agencies (Amd. Cplt. at 29);

(3) filing a lawsuit against investors who communicated with the SEC (Amd. Cplt. at 30); and

(4) intimidating other investors by telling them that they intended to add other investors as additional defendants in the company’s lawsuit (Amd. Cplt. at 31).

Context Of The SEC Whistleblower Protection Rules Violations

The alleged violations of the SEC’s whistleblower protection rules arose in the context of an SEC civil lawsuit against Collectors Café and Mykalai Kontilai. Kontilai is the founder, president, and CEO of Collectors Café.

The SEC’s court Complaint alleges that Kontilai raised approximately $23 million from at least 140 investors for Collectors Café. According to the SEC, Kontilai did this through written and verbal communications that contained false or misleading statements and material omissions. The Complaint also alleges that Kontilai misappropriated more than $6.1 million of investors’ money to fund his lavish lifestyle. (Amd. Cplt. at 2, 8.)

In addition, the Complaint alleges that to conceal his conduct and to mislead the SEC, “Kontilai knowingly created and presented the SEC staff with fabricated documents”. (Amd. Cplt. at 11.)

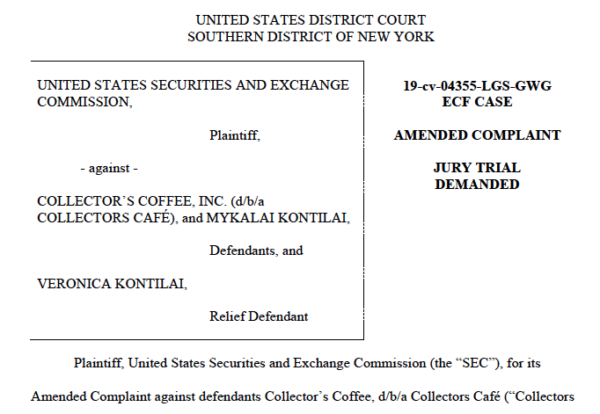

The SEC’s amended court Complaint

Collectors Café’s Stock Purchase Agreement Allegedly Violated SEC Whistleblower Protection Rules

The amended Complaint alleges that after certain investors expressed concerns about their investments in Collectors Café, Kontilai arranged for his sister-in-law to purchase their stock in the company. (Amd. Cplt. at 27.)

The sale was effectuated by a stock purchase agreement (“SPA”) signed by Kontilai on behalf of Collectors Café. The SEC alleged that the SPA violated SEC whistleblower protection rules by including language that prevented the investors from communicating with governmental agencies. The amended Complaint quotes the SPA:

[Investors] …. further warrant and affirm that … they will not, directly or indirectly, individually, collectively or otherwise, contact any third-part, including, but not limited to governmental or administrative agencies or enforcement bodies, for the purpose of commencing or otherwise prompting investigation or other action relative to [Collectors Café] or the subject matter herein.

(Amd. Cplt. at 28)(brackets and ellipses in original.) In a perhaps unintentionally droll pleading, the amended Complaint then alleges that “The SEC is a governmental agency that investigates the type of misconduct raised by the investors”. (Amd. Cplt. at 28.)

Collectors Café’s Settlement Agreement Allegedly Violated SEC Whistleblower Protection Rules

Approximately one and a half years after the SPA, two investors sued Collectors Café for securities fraud, among other things. A little more than a month later, Collectors Café, Kontilai, and the two investors resolved the lawsuit by entering into a confidential settlement agreement.

As with the SPA, the settlement agreement allegedly violated whistleblower protection rules by prohibiting the investors from communicating with governmental agencies. But this time, the document specifically identified the SEC by name:

The Shareholders … will not initiate on a going forward basis, any communications with any regulatory agencies such as the United States Securities and Exchange Commission or any other Federal, State, or Local governmental agency concerning the matters related to this Agreement. Nothing herein would prevent the parties from responding to, and/or fully complying with, a subpoena or other governmental and or regulatory compulsory process.

(Amd. Cplt. at 29)(emphasis in original.) After the settlement agreement was executed, a lawyer for the investors told the SEC that the settlement agreement “prevented his clients from speaking to SEC staff voluntarily”. (Amd Cplt. at 30.)

Collectors Café’s Lawsuit Against The Two Investors Allegedly Violated SEC Whistleblower Protection Rules

A little more than six months after the settlement agreement, counsel for Collectors Café and Kontilai informed the two investors’ lawyer that they had reason to believe that one or more of them had been communicating with the SEC.

A few months later, Collectors Café and Kontilai sued the investors for “fraud, breach of contract, unjust enrichment, intentional interference with contractual relations, civil conspiracy, and breach of implied covenant of good faith and fair dealing”. (Amd. Cplt. at 30.) Their lawsuit against the investors sought both punitive and compensatory damages. (Amd. Cplt. at 31.)

According to the SEC, “Each of the claims asserted in the 2019 Lawsuit are based on the factual allegation that the investors communicated with the SEC about Collectors Café and Kontilai”. (Amd. Cplt. at 30.)

The SEC characterized the lawsuit as a violation of whistleblower protection rules, in that it was intended “to impede investors from communicating directly with SEC staff about a possible securities law violation, including by enforcing and threatening to enforce confidentiality agreements”. (Amd. Cplt. at 31.)

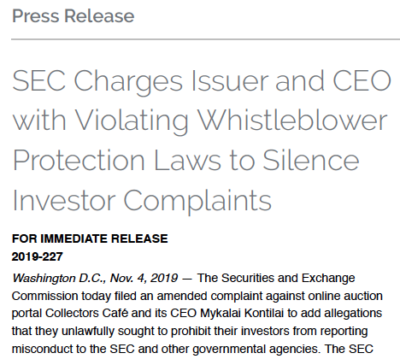

The SEC’s press release

The SEC’s press release

Kontilai’s Telephone Call With Investors Allegedly Violated SEC Whistleblower Protection Rules

The SEC claimed that Collectors Café and Kontilai “flaunted to other investors the fact that they had sued investors for communicating with the SEC”. (Amd. Cplt. at 3.) Allegedly, in a telephone call with all investors, “Kontilai repeatedly referenced this lawsuit to the investors, touting the damages that he had claimed and that he intended to amend this lawsuit to include others whom he viewed as the source of the company’s troubles”. (Amd. Cplt. at 31.)

As with the lawsuit against the investors, the SEC said that this, too, violated whistleblower protection rules by impeding investors from communicating directly with the SEC. (Amd. Cplt. at 31.)

The SEC’s Amended Complaint Includes A Claim For Relief For “Impeding”

The SEC’s amended Complaint includes a claim for relief for violating Securities Exchange Act Rule 21F-17, 17 C.F.R. § 240.21F-17. (Amd. Cplt. at 40.)

The SEC named this cause of action “Impeding”. (Amd. Cplt. at 39, Fifth Claim For Relief.)

In the SEC’s press release about the amended Complaint, the Director of the SEC’s Denver Regional Office stated, “We allege that the defendants attempted to cover up their fraud by holding investors’ money hostage until the investors signed agreements preventing them from seeking law enforcement intervention”.

The press release also quoted the Chief of the SEC’s Office of the Whistleblower, “The SEC’s whistleblower protections broadly protect not just employees, but anyone who seeks to report potential securities law violations to the Commission”.

* * *

About the Pickholz Law Offices LLC

The Pickholz Law Offices LLC is a law firm that focuses on representing clients involved with investigations conducted by the U.S. Securities and Exchange Commission, FINRA, and other securities regulators.

The Pickholz Law Offices has represented employees, officers, and others in SEC whistleblower cases involving financial institutions and public companies listed in the Fortune Top 10, Top 20, Top 50, Top 100, Top 500, and the Forbes Global 2000. We were the first law firm ever to win an SEC whistleblower award for a client on appeal to the full Commission in Washington. Inside Counsel magazine named this achievement one of the five key events of the SEC whistleblower program. Examples of the Firm’s SEC whistleblower cases are available here.

In addition to representing SEC whistleblowers, since 1995 the Firm’s founder, Jason R. Pickholz, has also represented many clients in securities enforcement investigations conducted by the SEC, FINRA, the U.S. Department of Justice and US Attorney’s Offices, State authorities, and more. Examples of some of the many securities enforcement cases that Mr. Pickholz has been involved with are available here.

You can see what actual clients have had to say about The Pickholz Law Offices by going to the Client Reviews page on our website or by clicking here.

How to Contact the Pickholz Law Offices LLC

If you would like to speak with a securities lawyer or SEC whistleblower attorney, please feel free to call Jason R. Pickholz at 347-746-1222.

The Pickholz Law Offices remains open and will be fully operational through teleworking while we all grapple with this terrible pandemic. We hope that all of our clients, colleagues, friends, and their families remain safe and healthy. Our thoughts and prayers go out to everyone who has been affected by COVID-19.